25+ tax on mortgage payments

For the transaction to complete you must. If the borrowers make a down.

Faq Are Mortgage Payments Tax Deductible Hypofriend

Using this model you can spend up to 1250.

. The coverage protects the lender. Web If the mortgage closes on Jan. 25 you owe 16110 for the seven days of accrued interest for the remainder of the month.

The next monthly payment the full. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. If youre buying a house and need help finding a great home in your price range be sure youre working with a top-notch real estate professional who can help you find the house of your dreams.

Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes. Ad Compare More Than Just Rates. Web The more conservative 25 model says you should spend no more than 25 of your post-tax income on your monthly mortgage payment.

Never spend more than 25 of your monthly take-home. In some cases borrowers may put down as low as 3. Web If your mortgage provider is in trouble its customer service wing will probably take a beating making it difficult to get a hold of someone to walk you through.

Homeowners who bought houses before. Web If his 174-per-cent fixed-rate mortgage renews at an assumed 45 per cent in September 2024 Aidens payments would need to rise by 455 a month to 1855 to. Web To put this into perspective Ramsey explains that if you take home 5000 per month after taxes according to his 25 rule you should pay no more than 1250 per month for a mortgage payment.

Figure out 25 of your take-home pay. Dial 1-877-690-3729 to pay by phone. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Web A good gauge to tell if you can afford a mortgage is if the monthly payments are no more than 25 of your monthly take-home pay. For example if your monthly take-home pay. Web Most lenders require private mortgage insurance or PMI when a buyer cannot make a down payment of at least 20 of the purchase price.

Web With this model no more than 25 percent of your after-tax income goes toward your monthly mortgage payments. Web Thats a gross monthly income of 5000 a month. Web Most home loans require at least 3 of the price of the home as a down payment.

Web Lets say you earn 5000 after taxes. To calculate how much you can afford with the 25 post-tax model multiply 5000 by 025. See how changes affect your monthly.

To calculate how much house you can afford use the 25 rule. 5000 x 028 1400 total monthly mortgage payment PITI Joes total monthly mortgage payments including. Some loans like VA loans and some USDA loans allow zero down.

Find A Lender That Offers Great Service. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. The flat amounts for standard deductions for the 2022 tax year will be.

Although its a myth that a. Web The agency has a standard deduction that simplifies tax-filing with a flat amount. Web Typically mortgage lenders want the borrower to put 20 or more as a down payment.

Web This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI. For example if you earn. You will need the Rice County jurisdiction code of 3321 and your property ID number.

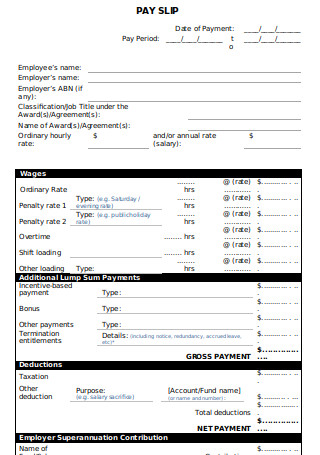

25 Sample Payroll Slip Templates In Pdf Ms Word

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Education Loan Details Student Loan Facts You Need To Know Idfc First Bank

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

Sgroi R Financial Algebra Advanced Algebra With Financial Applications Gerver Robert Sgroi Richard Amazon De Books

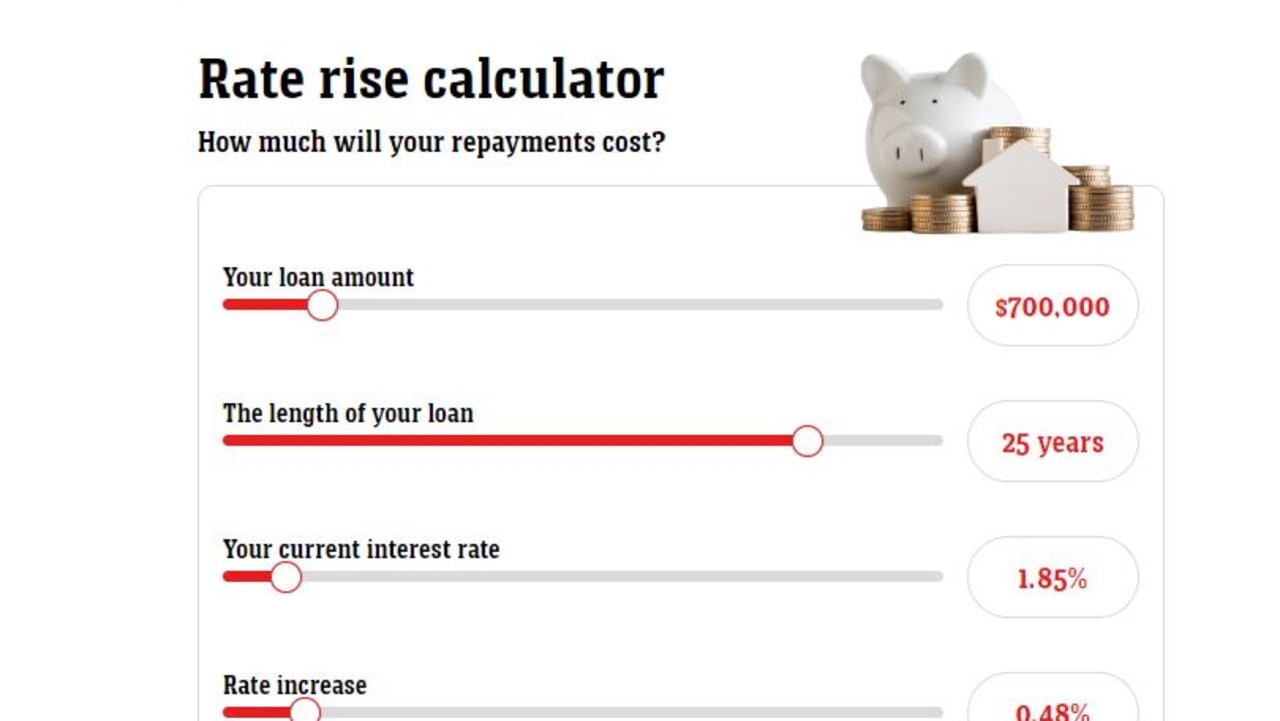

Rba Interest Rates Rise To 1 85 How Much Your Mortgage Will Go Up News Com Au Australia S Leading News Site

Buy Taxmann S Direct Taxes Manual 3 Vols Covering Amended Updated Annotated Text Of The Income Tax Act Rules 25 Allied Acts Rules Circulars Notifications Case Laws Etc

Doing Business In East Europe Central Asia

How Are Dividends Taxed 2023 Dividend Tax Rates The Motley Fool

Buying An Apartment In Munich Does Not Make Sense Financially Today Contradict Me R Munich

Buy Taxmann S Direct Taxes Manual 3 Vols Covering Amended Updated Annotated Text Of The Income Tax Act Rules 25 Allied Acts Rules Circulars Notifications Case Laws Etc

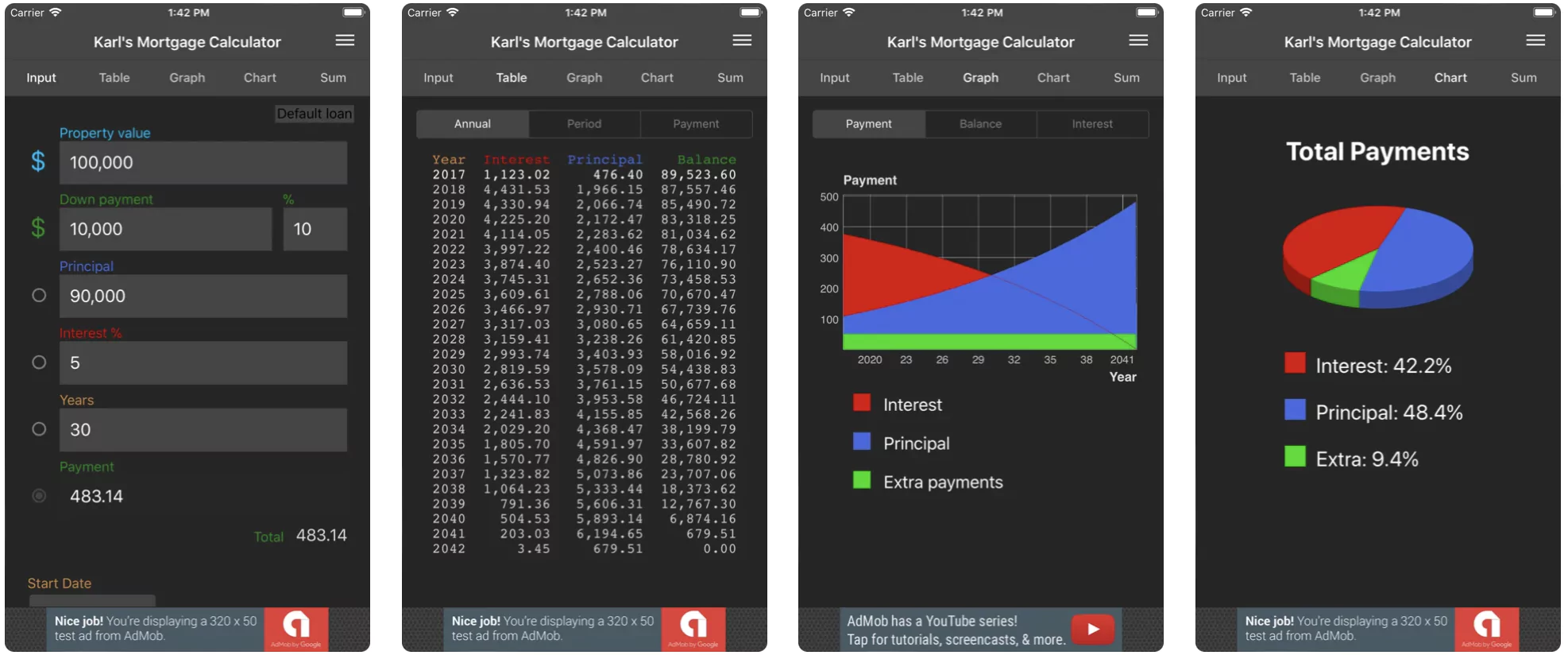

10 Best Financial Mortgage Calculator App For Iphone Ipad In 2023

Home Loan Tax Benefit Calculator Income Tax Saving Calculator Bajaj Finserv

5 Tax Planning Ideas To Consider Before Year End Apprise Wealth Management

Are Your Mortgage Payments Tax Deductible In 2022

Total Tax Accountants High Wycombe

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage